Commentary by Grant Laschowski and Shiraz Ahmed

In this issue:

- Global equities, fixed income/interest rates, and commodities

- What’s going on with Canadian real estate?

- Economic calendar

- Educational resources

Welcome to the latest edition of our Investor Newsletter, where we provide you with insightful updates and analysis on the ever-evolving financial landscape. The past quarter witnessed a series of significant events that have shaped market dynamics and investor sentiment.

Global equities, fixed income/interest rates, and commodities

Global equities

Source: YCharts.com

Every now and then, the good times just keep rolling. Following a robust finish to 2023, stock markets have maintained their momentum into 2024. As we highlighted in our last Investor Newsletter [link], both Canadian and U.S. markets witnessed remarkable growth, with gains exceeding 10 percent for the last quarter of 2023. Impressively, the S&P 500 (purple) has replicated this feat, surging over 10 percent in the first quarter of this year – marking the first consecutive quarters of +10 percent returns since 2012 and only the third occurrence in the past 38 years. This upward trend is significant by any measure.

The reasons behind this surge are compelling. Inflation has dropped from 9.1 percent to 3.2 percent, GDP stands strong at over three percent (the highest among G-7 countries), and historical data since 1928 indicates that the S&P 500 has only recorded negative returns in an election year on four occasions. Moreover, during years when a Democrat held office and another Democrat was elected, the average total return for the year was 11.0 percent, while it averaged 12.9 percent when a Republican succeeded a Democrat. With the U.S. election scheduled for later this year, there's optimism that the U.S. market will end the year positively.

On the Canadian front, the situation appears less rosy. Labour productivity has dipped for the third consecutive year (a first-time occurrence), annual immigration has quadrupled since pre-Covid levels, and housing supply has reached historic lows. More on this later. The Bank of Canada (BoC) acknowledges these economic challenges and has indicated that rates are restrictive. However, the BoC is waiting for inflation to slow to its two percent target before considering rate cuts. Acting too late risks recession, while acting prematurely could exacerbate housing market problem and inflation. By mid-year, we anticipate the BoC will have the evidence needed to begin rate cuts. This is likely to further depreciate the CAD dollar, which has already lost between 2-3 percent against the USD since the year began. In our assessment, the Canadian dollar will continue to depreciate towards $0.70, mostly because the economy is in a more precarious state compared to its U.S. counterpart.

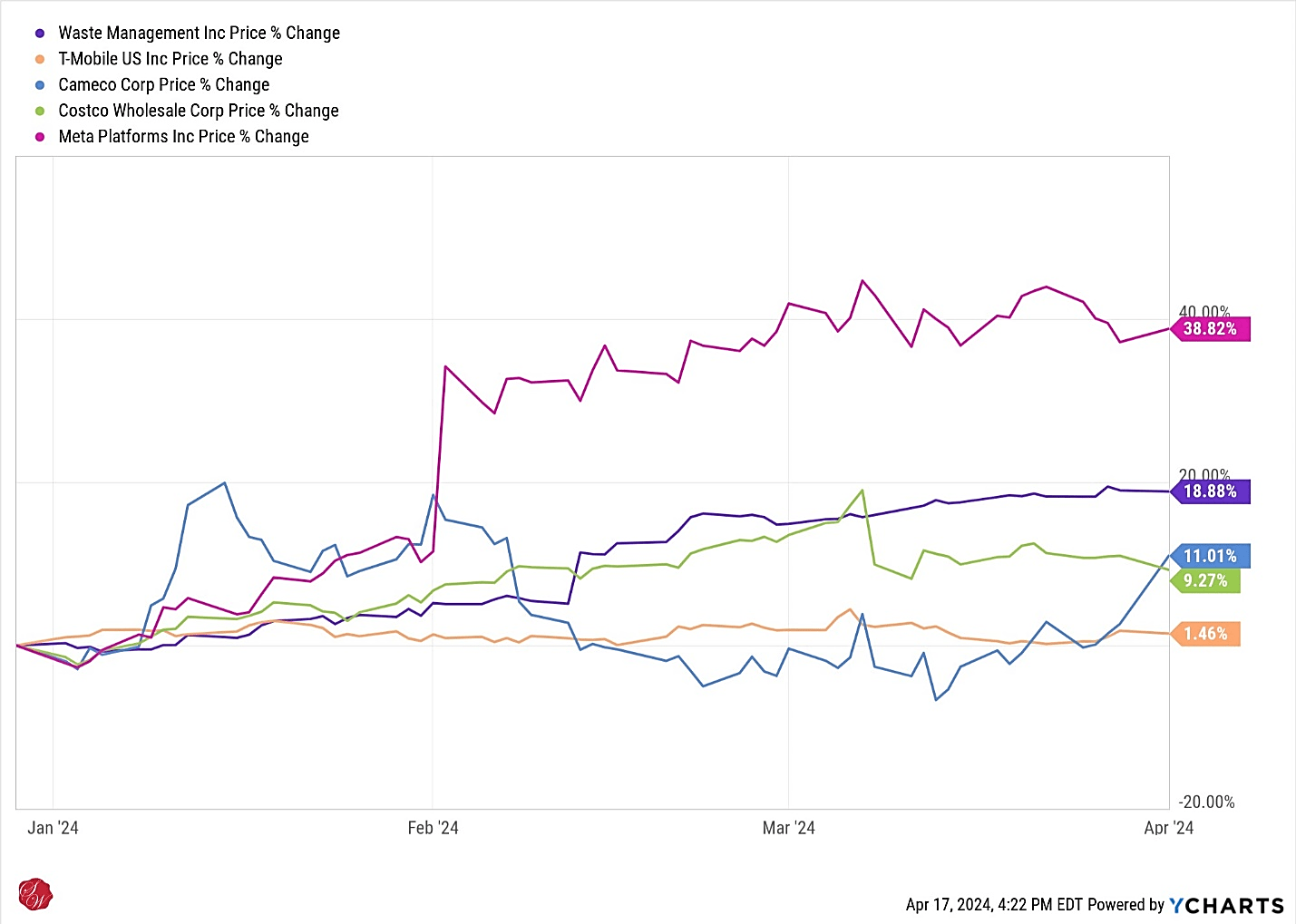

Source: YCharts.com

In our North American Equity model, which employs a quantitative investment approach, our top five positions as of January 1st were Waste Management (purple), T-Mobile (gold), Cameco (blue), Costco (green), and Meta (formerly Facebook – pink). With the exception of T-Mobile, our top holdings outperformed the broader markets, with Meta leading the pack with a nearly 39 percent increase in the first quarter. Waste Management, a prominent provider of waste management solutions, has proven to be an exceptional investment since November of last year when we initiated our investment in its stock. It has provided a safer and more profitable alternative to the S&P 500, yielding an increase of nearly 30 percent.

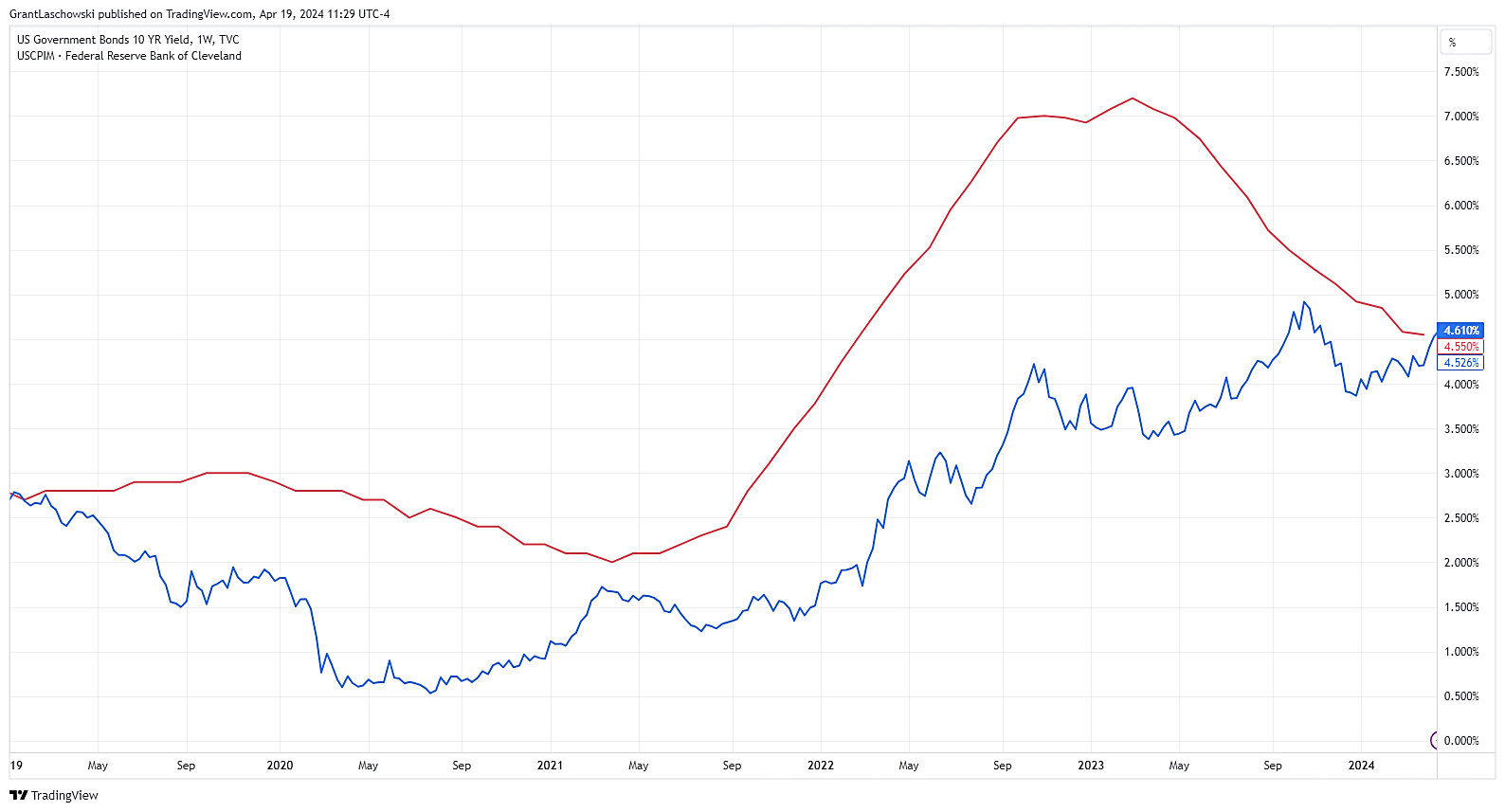

Fixed Income and Interest Rates

In my entire career, fixed income, which once seemed rather uneventful, has become both thrilling and complex in recent years. Previously, simplicity reigned: interest rates and yields were low, often trailing behind inflation, essentially guaranteeing a loss in purchasing power for many investors. This trend is perfectly captured in the chart below. Since 2019, U.S. inflation (orange) has consistently exceeded the yields on U.S. 10-year Treasuries (blue). During this period, numerous income-seeking investors ventured into dividend-paying stocks in pursuit of reasonable yields. Yet now, they find themselves with more choices.

The average yield on 1- to 3-year GICs (Canada) and 1- to 3-year CDs (U.S.) currently hovers around five percent - surpassing inflation rates in both countries. Yields on high-interest savings accounts (HISA) are also approaching five percent.

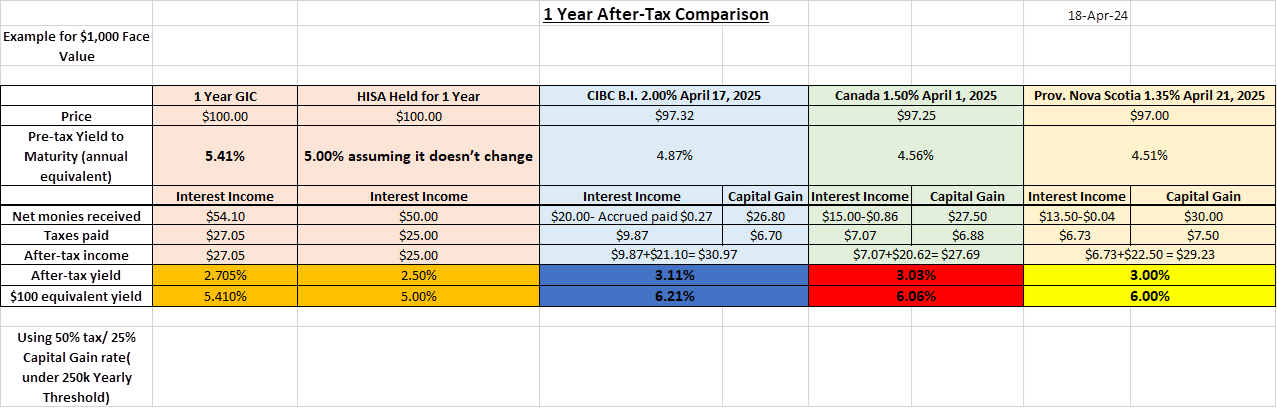

In registered accounts (e.g., RRSPs, IRAs), the interest earned from these income-generating investments benefit from tax deferral. However, in non-registered accounts (e.g., cash, margin, brokerage), any interest earned is subject to some of the highest tax rates. For such accounts, we typically direct our attention to individual bonds, particularly discounted corporate bonds, which offer investors a more tax-efficient means of generating income. This is because a significant portion of the returns from these bonds are categorized as capital gains, which are taxed more favourably than interest income.

Source: Raymond James Ltd.

The chart above underscores the disparity between a) 1-year GIC, b) HISA, and c) three discounted corporate bonds. As depicted, in each scenario, the bonds offer substantially higher after-tax returns for investors. For an investor facing a 50 percent tax rate on income and 25 percent on capital gains (and falling under the $250k annual capital gain threshold), discount bonds such as those offered by CIBC, equate to a GIC/HISA rate of approximately 6.21 percent.

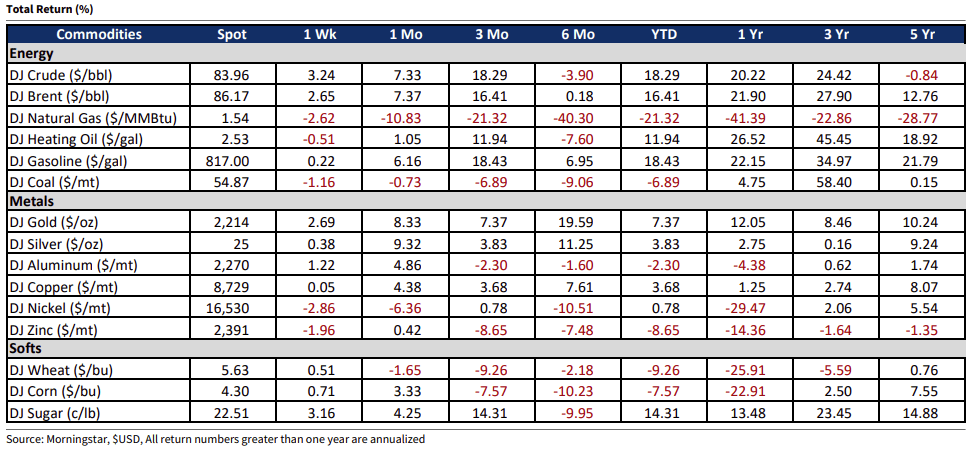

Commodities

The first quarter of 2024 witnessed a general uptrend in commodity markets, particularly in energies and metals. Despite initial expectations of subdued inflation and rate cuts, inflation remains persistent, supporting higher commodity prices. Gold and silver reached new highs due to central bank buying and global tensions. Energy sector gains were led by crude oil, supported by production cuts and geopolitical risks, while gasoline demand surged. Natural gas prices have faced significant challenges, driven by abundant supplies, warmer weather, and general bearish sentiment. Recent price lows have possibly been exaggerated, reflecting a disconnect between prices and fundamentals. The agricultural sector saw mixed performance as the outlook for commodities remains uncertain amidst geopolitical tensions, fluctuating energy markets, and weather-related risks affecting food prices. Despite these challenges, the potential for a commodity super-cycle persists, driven by factors like infrastructure spending, green energy initiatives, and rising global demand.

Looking ahead, diversifying portfolios with commodities may offer stability amidst record-high stock indices and low volatility. However, uncertainties persist, with global economic activity likely to soften commodity demand, while geopolitical tensions and supply chain disruptions could heighten price volatility.

What’s going on with Canadian real estate?

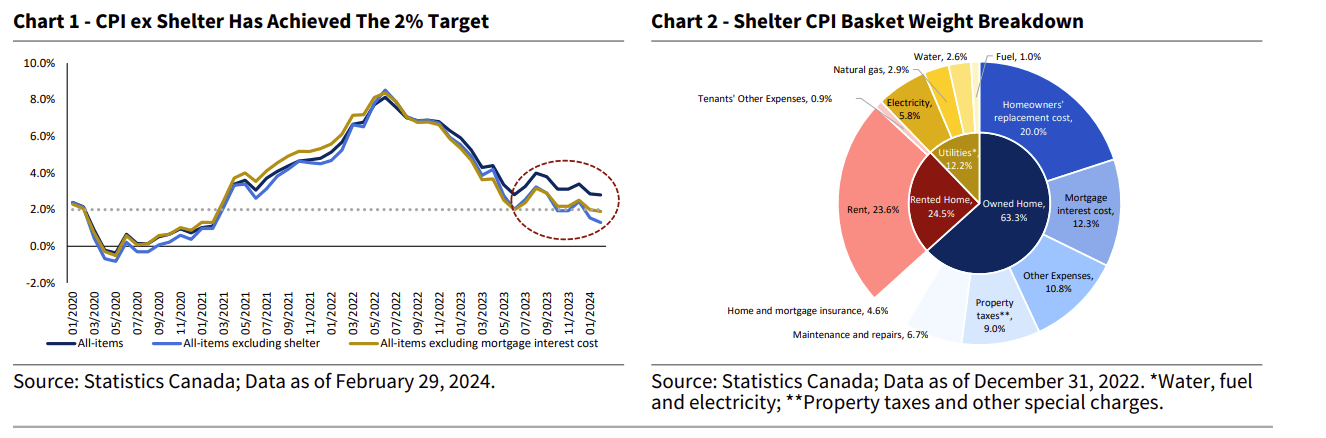

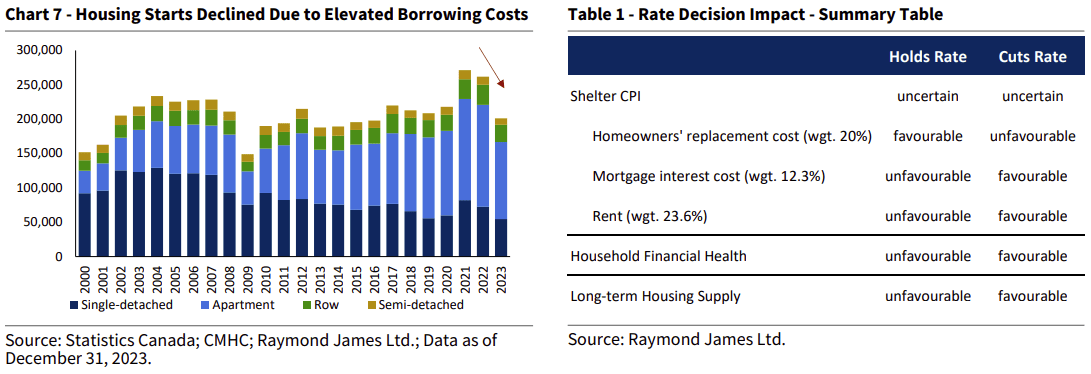

In March, the Bank of Canada (BoC) opted to maintain its target interest rate at five percent, citing underlying inflation as a factor in refraining from rate cuts. Canadian financial markets currently anticipate a 17 percent chance of a rate cut in April and a 67 percent chance in June.

Headline inflation in Canada remained above target, currently sitting at 2.8 percent, although by excluding shelter and mortgage interest costs, that metric would be at or below the two percent target (Chart 1). While a rate cut might initially appear to fuel housing prices and thus further elevate overall inflation, a closer examination of shelter inflation components reveals a less straightforward outcome. Shelter inflation (i.e., Shelter CPI) consists of three main components: owned accommodation, rented accommodation, and utilities, each with specific breakdowns. The significant contributors to the rise in shelter CPI, namely owned and rented accommodation, have experienced average year-over-year growth of six to seven percent, while utility spending has remained stable. Notably, the effects of rate decisions on these key components vary considerably.

Historically, the BoC target rate and new home prices have tended to move in opposite directions, as a lower target rate typically translates to lower mortgage interest rates, making it more favourable for home buyers. Despite a somewhat active market in the past three months, compared to a sluggish fall in 2023, the BoC is cautious about cutting rates further to avoid exacerbating housing price hikes. Shaun Cathcart, senior economist at CREA, suggests that attention may shift from the timing of rate cuts to the inventory of homes available for sale this year, highlighting the persistent supply issue. Approximately 36 percent of Canadians have mortgaged homes, while 23 percent own homes outright, and 41 percent rent. Following a substantial rate hike of 4.75 percent since March 2022, about 43 percent of Canadian mortgage holders felt financial strain upon renewing their terms through December 2023, with expectations of this number rising to 80 percent by the end of 2025.

The surge in housing prices is primarily due to a scarcity of supply and the swift population expansion fueled by immigration. Although the Canadian government is implementing measures to regulate the influx of international students and potentially enhance skilled labour recruitment, little headway has been made in rectifying the supply deficit. In 2023, housing starts plummeted, reverting to levels last seen in 2016. Developers are grappling with elevated borrowing expenses and rising construction costs.

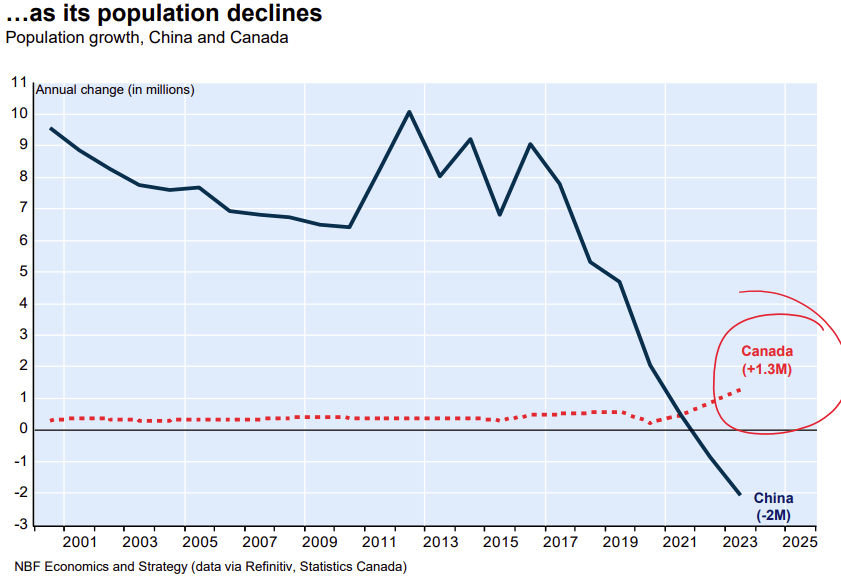

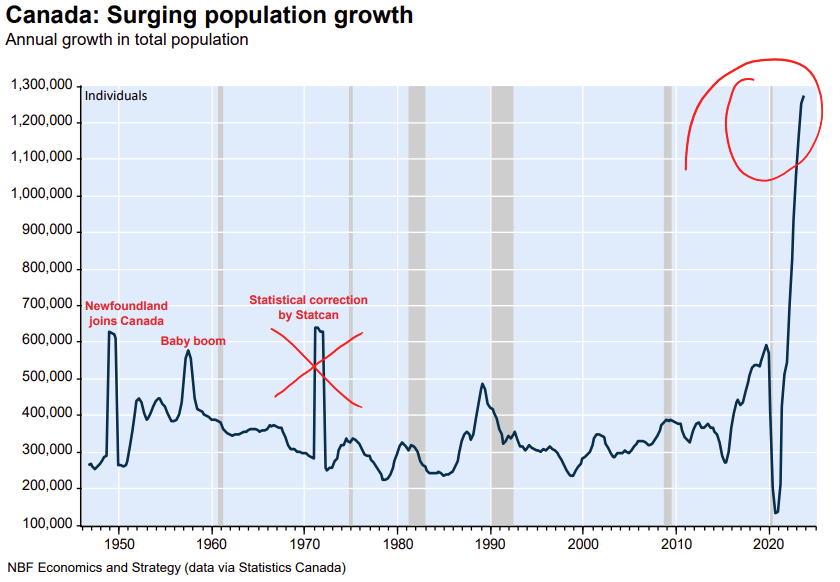

At our annual Portfolio Manager Symposium, Stefane Marion, Chief Economist and Strategist for National Bank, presented the following four graphics. Surprisingly, in 2023, Canada's population surpassed that of China – an unexpected development. Our country experienced a population growth of 1.3 million, approximately four times the pre-Covid rate, while low birth rates in China led to another year of decline. Canada's infrastructure is simply not prepared for such a rapid influx of immigrants.

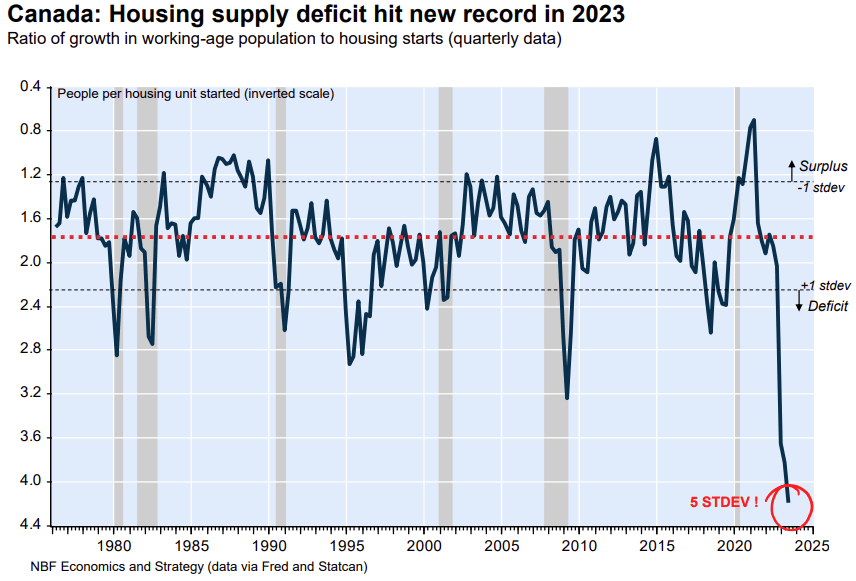

This has created an unprecedented strain on housing supply. The two charts below vividly depict these facts. Historically, Canada constructed one home for every 1.8 people – the figure of 1.8 accounts for the fact that, on average, more than one person resides in a home. Presently, we're barely constructing one home for every 4.2 people – marking the lowest level of development on record by a significant margin.

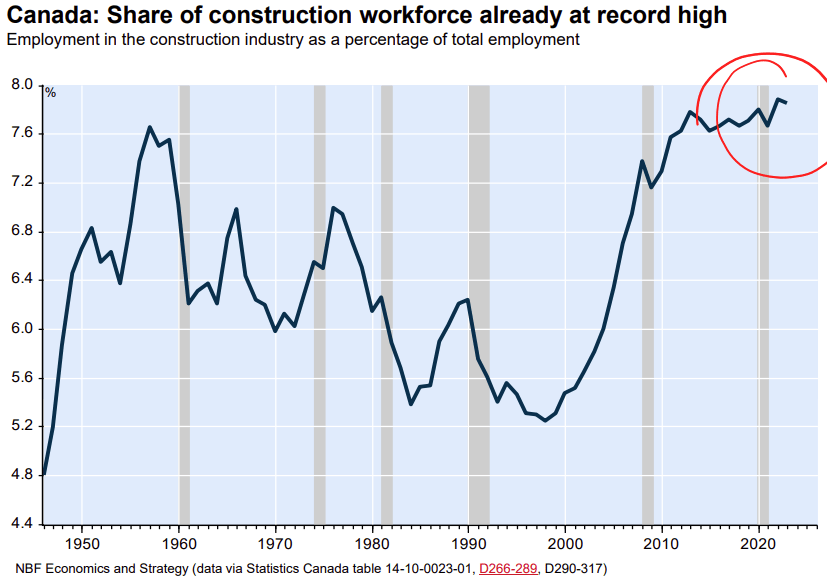

The solution: build more homes.

The problem: there aren’t enough people and shovels to build them.

While higher mortgage rates have resulted in fewer transactions, it's primarily the scarcity of supply that continues to keep prices elevated, hovering around 30 to 35 percent higher than pre-Covid levels. Despite Canada currently employing a record number of construction workers, we still face a shortfall of 700,000 homes to meet demand. This is a deep-rooted structural problem that is unlikely to be resolved in the near future.

Economic Calendar

Here is a list of some of the major economic data that is scheduled to be released during the second quarter of 2024.

- April 10: U.S. Inflation Data Release

- April 10: Bank of Canada Interest Rate Decision

- April 16: Canada Inflation Data Release

- April 25: U.S. GDP Announcement

- April 30: Canada GDP Announcement

- May 15: U.S. Inflation Data Release

- May 20: Victoria Day in Canada

- May 21: Canada Inflation Data Release

- May 27: Memorial Day in the U.S.

- May 30: U.S. GDP Announcement

- May 31: Canada GDP Announcement

- June 12: U.S. Inflation Data Release

- June 19: Juneteenth National Independence Day in the U.S.

- June 25: Canada Inflation Data Release

- June 27: U.S. GDP Announcement

- June 28: Canada GDP Announcement

Educational Resources

As we close out another quarter, we also keep publishing short videos on our YouTube channel, covering all sorts of financial topics. Be sure to follow our channel, and if you have any specific topics you'd like us to cover in future videos, feel free to email Shiraz Ahmed at shiraz.ahmed@raymondjames.ca. Below are a few examples of some recent videos we've done and a few of the articles Shiraz was featured in.

- Cars That Hold Their Value in 2024 [click to view]

- How do financial advisors get paid? [click to view]

- Breakfast Television Interview | Here's what you should know before spending your tax refund [click to view]

- Breakfast Television Interview | This Money Hack Will Help Saving For Your Future [click to view]

Information in this article is from sources believed to be reliable; however, we cannot represent that it is accurate or complete, and it should not be considered personal taxation advice. We are not tax advisors, and we recommend that clients seek independent advice from a professional advisor on tax-related matters. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Shiraz Ahmed, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor's circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member Canadian Investor Protection Fund. Raymond James (USA) Ltd. (RJLU) advisors may only conduct business with residents of the states and/or jurisdictions for which they are properly registered. Therefore, a response to a request for information may be delayed. Please note that not all of the investments and services mentioned are available in every state. Investors outside of the United States are subject to securities and tax regulations within their applicable jurisdictions that are not addressed on this site. Contact your local Raymond James office for information and availability. This website may provide links to other Internet sites for the convenience of users. RJLU is not responsible for the availability or content of these external sites, nor does RJLU endorse, warrant, or guarantee the products, services, or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy that RJLU adheres to. Investing in foreign securities involves risks, such as currency fluctuation, political risk, economic changes, and market risks. Raymond James (USA) Ltd., member FINRA/SIPC. This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy which Raymond James Ltd adheres to.