2022 Q1 Investor Update Letter

Commentary by Shiraz Ahmed and Grant Laschowski

In this issue

- Inflation and interest rates

- War in Ukraine

- Global markets

- Current trends

As an avid kickboxer (more specifically Muay Thai), I found practicing with the heavy bag and sparring to be a fantastic workout. It also happened to be a great stress reliever after a hard day of work, given the nature of my job! Despite all the time and effort, I have spent training over the years, it always sucks to get struck by an opponent. Every time I would face a new sparring partner, unfortunately, by the time I figured out that person's fighting style, my opponent would change the following week. This always reminds me of the quote from Katherine Dunn, "In boxing, it's the punch you don't see coming that knocks you out.” I have yet to figure out how to anticipate the strike I cannot see coming from opponents who change routinely.

If you are looking to avoid that knock-out blow in your portfolio, the good news is we recommend some simple, straightforward steps to investors to avoid such a blow. One tip is to ensure that you are building a diversified portfolio that consists of major asset classes such as equities, bonds, and alternative investments.

Inflation and interest rates

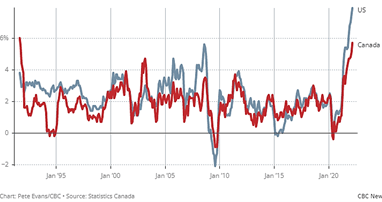

We have not witnessed price increases like this in nearly 40 years. Supply chain issues, primarily caused by the global pandemic and the great resignation, have led to price surges in everything from timber to groceries to gasoline and nearly everything in between. Inflation (i.e., the change in the price of goods and services) typically ranges between 1-3% per year and has for some time now (see above graphic). But things are much different now. Inflation has recently surged to over 5% in Canada and around 8% in the United States. Understanding how this impacts our everyday lives is as easy as taking a trip down to the nearest gas pump. Recently, the main culprit for such increases is the current war in Ukraine. More on that later. Every extra dollar spent at the pump takes away from spending on other luxuries, like going on that first vacation since the start of the pandemic or taking the family out to a game or restaurant. For many young investors, rising interest rates and inflation at 40-year highs is something new and unwelcomed, but for those more seasoned investors, this is simply a flashback to the kind of rates we saw in the 1980s. The reason why interest rates tend to increase during times of high inflation is quite simple. When the central banks notice inflation (i.e., price increases) getting out of control, they raise interest rates, making borrowing more expensive to cool down demand. Think of this as moving the “interest rate lever” up or down to help control the market. In simplistic terms, ask yourself if you might be inclined to buy a more expensive home if your mortgage rate is at 1% vs. 5%? When demand outstrips supply, prices tend to increase, which is okay. As rates rise, we all tend to pull back on spending, driving down overall demand for goods and services and reducing inflation. This is what the central banks are currently trying to achieve with their recent interest rate hikes.

It is also essential to know that interest rates have an inverse (i.e., opposite or inverse) effect on bond prices. As interest rates decline, which they have for the past four decades, bond prices increase. Those +10% yielding bonds from back in the 1980s now command a significant premium today because investors have two choices – purchase low-yielding bonds in the current market or pay a premium for higher-yielding older bonds. This has been great for retirees or others living on a fixed income who have hung onto those bonds for years, but it seems these glory days are coming to an end. Rates are increasing to combat inflation. This means tough times ahead for fixed-income investors, as their lower-yielding older bonds will now have to be sold at a discount as investors can go into the market and purchase higher-yielding options. Such dynamics can sometimes force conservative investors to move up the risk spectrum into dividend-paying stocks in search of higher yields, which brings forth its own new set of risks.

We expect that the factors increasing inflation will remain elevated in 2022 and above trend in 2023. Recent geopolitical events, such as the most recent Russian invasion of Ukraine and the subsequent imposition of significant sanctions on Russia (a major commodity producer which represents 12.1% of global oil production as of December 20201), in addition to ongoing supply chain disruptions, most notably in China (e.g., lockdowns in Shenzhen/Shanghai due to the government’s zero-tolerance COVID-19 policy), have only worsened the inflationary pressures already present.

War in Ukraine

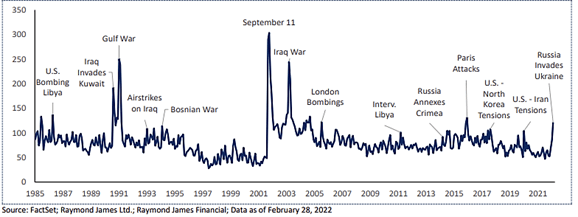

Well, that escalated quickly from a buildup of Russian troops along the Ukrainian border to a full-blown invasion in less than a month. While the world prepared for such events, the speed and magnitude of the move caught everyone off guard. The morning after the invasion, the S&P 500 Index dropped 2.4%, marking the 5th straight day of market declines as investors weighed the severity of such events. Within a week of the invasion, the world responded by cutting Russian banks from SWIFT, banning Russian planes from EU and US airspace, and imposing a slew of sanctions against Russian firms, oligarchs, and financial service firms. Overall, geopolitical risk (see Geopolitical Risk Index below) will likely be significantly higher this year, raising the prospect of expanded economic confrontation and associated economic disruption stemming from Russia’s invasion of Ukraine.

Geopolitical Risk Index

These uncertainties have already resulted in downward revisions to 2022 global real GDP forecasts, which we had already anticipated; however, the downward revisions have been more aggressive for several Asian, Emerging, and European economies, while commodity-oriented regions and North American developed economies have experienced quite the opposite. Similar to 2021, we expect the recovery to remain uneven in 2022 and 2023. The latest forecast for global GDP growth puts real GDP growth at +3.0% year-over-year (YoY) for 2022. This compares to the 20-year average (2000-2020) of ~3.2% YoY. From a global economic perspective, the “cleanest dirty shirts in the laundry” from a global economic perspective remain the Canadian and US economies, which are both set to grow by +3.8% and +3.1%, respectively, in 20221.

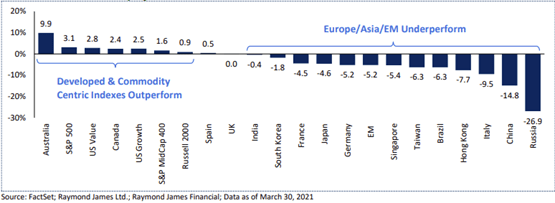

Performance of Global Equity Markets/Indexes since the Russia/Ukraine Crisis

While there are apparent downside risks to these estimates for Canada and the US, we note both economies are trending almost 2x above their 20-year averages in real terms and are much better positioned versus many of their global peers with a sufficient buffer built-in above their historical run-rate to help cushion against potential headwinds on the horizon.

Global markets

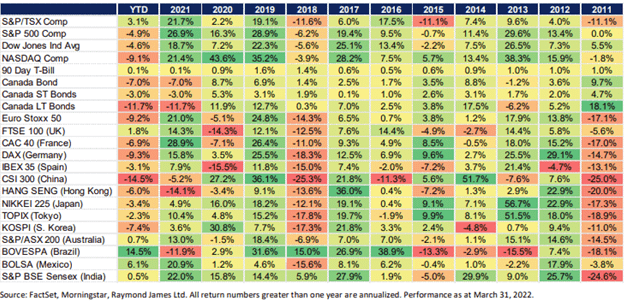

Higher food costs, disrupted supply chains and trade flows, rising interest rates, and lower business and consumer confidence levels have led some to call for an anti-goldilocks economy - where inflation runs high, and growth runs slow. Year-to-date, only a few commodity-driven countries, such as Canada, Brazil, and Mexico, have witnessed positive returns (i.e., > +1%) in their equity indices (see Market Quilt below).

Market Quilt: Calendar Year Returns

In Canada, our economic backdrop remains on a solid footing, with GDP growth recovering strongly, albeit with huge variations by sector. While real disposable income is expected to fall this year, the high household savings rate – 6.4% in the fourth quarter – provides plenty of dry powder for actual consumption to recover further in 2022 and beyond. This helps explain the resilience in consumer confidence, which has fallen only slightly in recent months and remains consistent with real consumption growth at close to 4% YoY. There are mixed signals for residential investment this quarter. Housing starts have fallen since the end of last year, but that should be partly offset by the renewed strength of home sales in February. The recent surge in interest rate expectations is a crucial risk to the housing sector, which, since the pandemic lows, has been a sizable contributor to GDP growth1.

In the United States, weekly jobless claims recently hit their lowest levels since 1968. Throughout the pandemic, terms like The Great Resignation were all the buzz, as workers cited low pay, no opportunities for advancement, and feeling disrespected. As employers strive to keep their workers, labor participants are being drawn back to work now that pandemic-related conditions have improved.

There is a tremendous amount of uncertainty around the forward earnings outlook and the overall economic outlook, although currently, both variables are strong in the US. Currently, S&P 500 earnings-per-share (EPS) is still trending up, but we suspect this may end during the Q1 earnings season, most notably due to companies with global exposure.

The US economy is far better positioned than Europe/Asia/EM. This is likely to drive further capital flows to the US as a “safe haven.” It doesn’t mean absolute returns will be great, but relatively, the US looks like a better bet than the rest of the world. Companies with US exposure will likely fare better than companies with global exposure in the near term in terms of EPS trends. This preference cuts across sectors and styles, as there are companies in every industry with more US exposure vs. Global. Services companies will likely fare better than goods companies from an EPS perspective, partly because goods companies generally have more global supply chains (risk) and partially because, as COVID trends come down, consumers in the US are returning to more normal behavior, which means more services spending and fewer goods spending, at the margin.

Globally, investor confidence has fallen sharply in 2022, exacerbated by the Russia-Ukraine crisis. Europe’s significant reliance on oil and natural gas from Russia (i.e., 40% of the gas Europeans burned in 2021 came from Russia) has forced the Eurozone Sentix Investor Confidence Index, which rates the relative six-month economic outlook for the eurozone, to its lowest levels since the start of the pandemic. As a result, Eurozone shares fell sharply during the first quarter, especially in the consumer discretionary and information technology sectors. UK stocks proved to be highly resilient during the first three months of 2022. The FTSE 100 index rose over the quarter, driven mainly by the energy, commodity, and financial sectors.

Current trends

It is widely cited that most retail investors tend to sell winning stocks too early and hold on to losing stocks too long. This phenomenon in behavioral finance is known as the disposition effect. Such events occur for numerous reasons, including a lack of planning. Not having an exit strategy before placing a trade creates an emotional scene where the profit/loss potential is often determined through gut instincts and possibly luck, rather than the implementation sound, repeatable investment strategy.

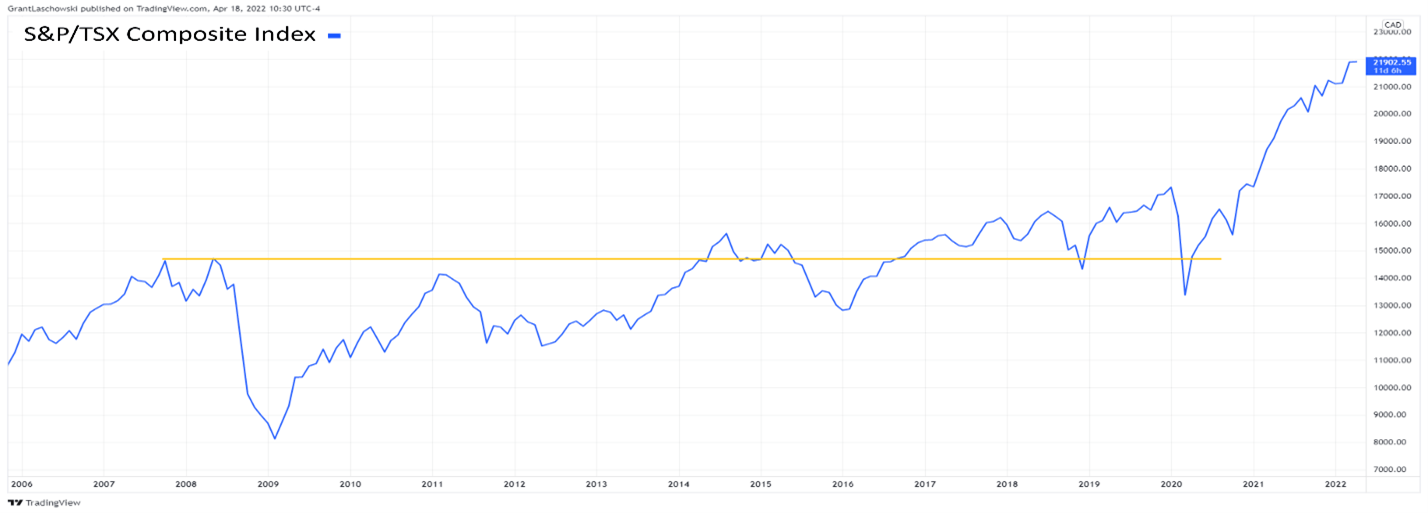

We often say, “the trend is your friend,” – but that only seems to resonate with investors when the party is rocking and rolling, and markets are going up. What about when they do not? The ability to sidestep or sell investments with negative price movements is just as significant, often more critical, than picking the best winners during a bull market. For example, if you lose 50% on a $100,000 investment, you are left with $50,000. Intuitively, most investors think earning back that 50% will break them even, which it does not. Earning 50% on $50,000 only brings you back to $75,000 – so you will need to make 100% to get back to $100,000 and earning those types of returns in a normal market can often take years. Look no farther than the TSX Composite Index for an example of a market, to varying extents, that stayed "under-water" for over a decade following the global financial crisis in 2008 (see S&P/TSX Composite Index below). In our world, minimizing this drawdown is called “downside protection” and truly solidifies why we often preach diversification and trend-following at Sartorial Wealth.

Source: Tradingview.com

Source: Tradingview.com

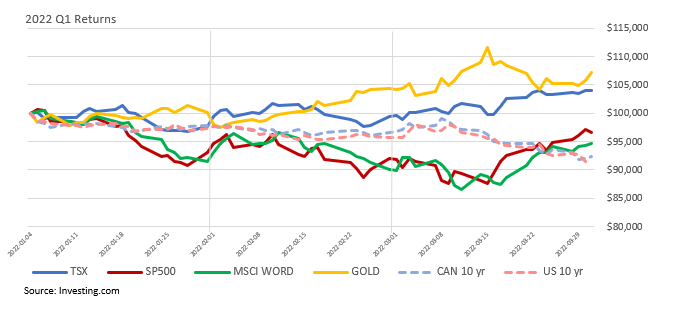

Looking at some of the major markets and assets classes we follow (see 2022 Q1 Returns below), we can see significant divergences starting to take place. Gold (solid yellow), up +6.6% on the quarter, was the best performing asset class of the bunch, followed by Canadian equities (solid blue), which benefited greatly from higher oil prices, moving the TSX Composite Index up +3.1% during the first quarter of the year. US (solid red) and World (solid green) equities have struggled, especially in February, reporting –4.9% and -5.3% year-to-date returns, respectively2. What started as a slow decline in Canadian (dotted blue) and US (dotted pink) bonds in January and February quickly excelled to the downside in March, as rates on the Canada 10-year went from 1.33% to 2.30% and in the US from 1.73% to 2.32%2.

Source: Investing.com

Source: Investing.com

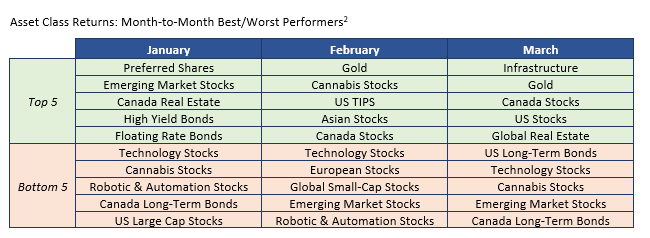

Breaking returns down further leads us to look at the best/worst performing asset classes each month (see Asset Class Return chart). In January, the US Federal Reserve chose not to raise interest rates, sending the market into a free- fall. Unprofitable companies, many found in tech, sold off aggressively. In mid-January, even massive firms like Amazon were down over -15%. Preferred shares (+1.73%), high-yield bonds (+0.37%), and Emerging Market stocks (+0.96%) were some of the few bright spots for the month. Nearly every other asset class experienced negative returns, with significant losses coming from cannabis (-12%), technology (-20%), and global dividend stocks (-9%)2. More losses were experienced across the board in February. This was when we started to see declines in stocks being offset by rising gold and commodity prices. As interest rates began their liftoff, we saw declines in bond prices across the duration spectrum, and short and long-term fixed-income products sold off. In March, the divergences continued, as clear winners in gold and Canadian stocks significantly outpaced significant fixed-income losses as rates continued to increase. Both global and US stocks saw an excellent rebound in the second half of March but continue to remain underwater for the year due to significant losses in January. In March, infrastructure stocks proved to be one of the best performing asset classes, retuning +7.8%2.

With elevated geopolitical risks and unfavorable monetary policies, we expect more volatility for the remainder of 2022. Bonds will likely continue to struggle as central banks attempt to curb inflation by raising interest rates. Canadian stocks are likely to outperform US and global markets due to higher commodity prices.

Diversification and capital preservation continue to remain our top priorities.

1 Information sourced from Raymond James Asset Allocation Quarterly Report

2 Information sourced from Investing.com.

Information in this article is from sources believed to be reliable; however, we cannot represent that it is accurate or complete, and it should not be considered personal taxation advice. We are not tax advisors, and we recommend that clients seek independent advice from a professional advisor on tax-related matters. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Shiraz Ahmed, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor's circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member Canadian Investor Protection Fund. Raymond James (USA) Ltd. (RJLU) advisors may only conduct business with residents of the states and/or jurisdictions for which they are properly registered. Therefore, a response to a request for information may be delayed. Please note that not all of the investments and services mentioned are available in every state. Investors outside of the United States are subject to securities and tax regulations within their applicable jurisdictions that are not addressed on this site. Contact your local Raymond James office for information and availability. This website may provide links to other Internet sites for the convenience of users. RJLU is not responsible for the availability or content of these external sites, nor does RJLU endorse, warrant, or guarantee the products, services, or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy that RJLU adheres to. Investing in foreign securities involves risks, such as currency fluctuation, political risk, economic changes, and market risks. Raymond James (USA) Ltd., member FINRA/SIPC. This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy which Raymond James Ltd adheres to.