2023 Q1 Investor Update Letter

Commentary by Grant Laschowski and Shiraz Ahmed

In this issue:

- Global markets

- Inflation and interest rates

- Banking crisis

- What we’re watching

- Our latest news and videos

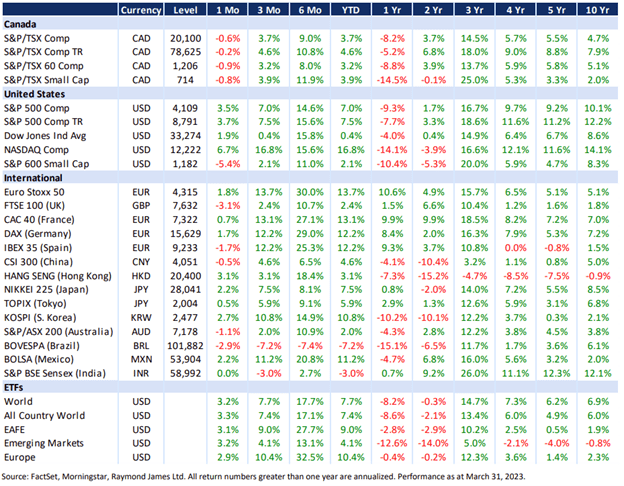

The first quarter of 2023 showed positive momentum in global stock markets, driven by the U.S. tech sector and the service sector in Europe. However, concerns about rising U.S. interest rates and a strengthening U.S. dollar led emerging markets to underperform developed markets. Fixed-income investments, such as bonds, are now an excellent option for investors looking for diversification and protection for their money. As inflation levels concern investors, we dive deeper into recent trends and discuss the potential impact on commodity returns.

With all this in mind, let's take a closer look at recent market developments and the outlook for the global economy in this quarterly newsletter.

Global markets

With the first quarter of 2023 officially in the books, we wanted to provide you with an update on recent market developments and the outlook for the global economy.

Overall, investors remain optimistic about the global economic recovery but have remained cautious about the potential risks posed by the recent rise in bond yields and inflation. The global tightening of central bank policies (i.e., higher interest rates) has primarily worked, as inflation levels worldwide have cooled in recent months.

There seems to be no end to the war in Ukraine, and tensions between the U.S. and Russia/China have risen. In February, a fighter jet shot down a suspected Chinese spy balloon, a dramatic public saga that only exacerbated the deteriorating relationship between the East and West.

Equities

Global stock markets have had a solid start to the year, particularly the U.S. tech sector (i.e., Nasdaq Comp), which is up approximately 15.6 percent year-to-date (YTD). In North America, equity markets marched higher during the first quarter, driven by optimism about the economic recovery, consumer spending, and strong corporate earnings. The recent fall of U.S. unemployment to 54-year lows has also helped boost investor confidence. While Canadian markets (i.e., S&P/TSX) have gained ground this year, their returns have been muted compared to other global markets, mainly driven by a significant decrease in oil and commodity prices, two of Canada’s most important revenue streams. The banking crisis that started in the U.S. with Silicon Valley Bank and ended in Europe with the collapse of Credit Suisse has been of significant concern. We’ll dive deeper into this, later in this newsletter.

In Europe, nearly across the board, equity markets have led the world in terms of returns. Two products we use, the iShares MSCI Europe IMI Index ETF (ticker: XEH) for our Canadian clients and the iShares Currency Hedged MSCI Eurozone ETF (ticker: HEZU) for our American clients, have assisted them in gaining access to these markets.

Despite the hit to bank shares in March, European stocks outperformed over the quarter, delivering 13.7 percent. Positive momentum in European stocks has been driven in large part by the service sector. From an individual country perspective, France (i.e., CAC 40) has led the way, up 13.1 percent YTD, followed by Germany (i.e., DAX) and Spain (i.e., IBEX 35), both of which have gained 12.2 percent this year.

In Asia, China finally ditched its zero-Covid policy at the end of last year, leading to a strong rebound in its economy as inflation has remained surprisingly low. China's parliament has approved a significant reform of central government institutions under the State Council, the country's cabinet. The changes include establishing a larger financial regulatory body and a national data bureau and restructuring the science and technology ministry. This bureaucratic restructuring is China's most extensive in years and supports its efforts to boost critical technology development, like advanced semiconductors, and reduce reliance on foreign technology. Emerging markets underperformed developed markets in Q1 2023 due to concerns about rising U.S. interest rates and a strengthening U.S. dollar.

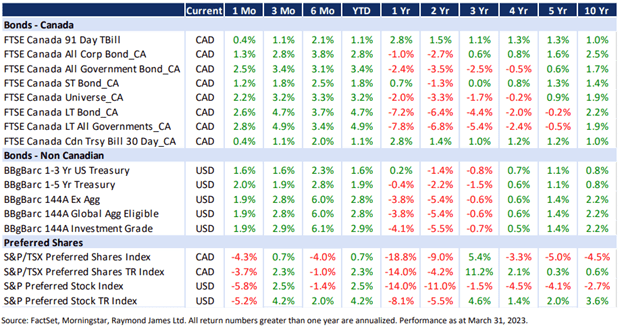

Fixed Income

Last year was horrible for fixed-income investors, as yields increased significantly and their existing bonds dropped in value. A positive aspect of this situation is that fresh capital can now be utilized at higher rates, which have not been observed since the subprime mortgage crisis of 2008. As of March 31, high-interest savings accounts (HISA) in Canada and certificates of deposits (CD) in the U.S. provide investors with nearly five percent return over one year.

When the market is unpredictable, fixed-income investments usually perform well. This is especially true after last year's market reevaluation, which caused current yield levels to increase significantly. Typically, bonds offer diversification and protection for your money, and they may increase in value if the economy worsens. Generally, bonds are a good investment option because they can generate income and buffer against potential economic problems.

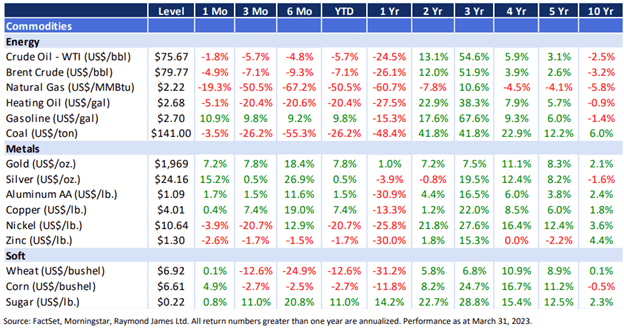

Commodities

During Q1 of 2023, the soft commodities sector saw an increase of 11.12 percent. While cotton prices decreased slightly, sugar, coffee, cocoa, and frozen concentrated orange juice prices rose. Gasoline and gasoline-refining spreads saw the most significant increase, with ethanol also experiencing a slight rise. However, crude oil, heating oil, and natural gas prices all decreased. As a result, the energy sector experienced an 11.96 percent decline during the quarter, making it the poorest-performing commodity asset class.

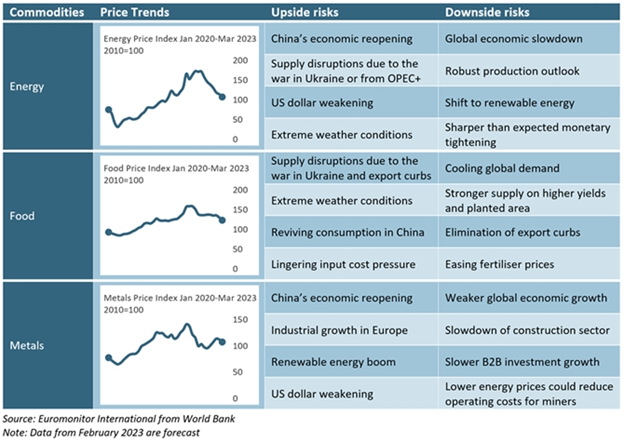

Due to the tightening money supply, the energy and natural resources industry is more concerned with current choices than future investments. With a potential global economic slowdown driven by a possible recession, commodity returns could be in for a bumpy ride in 2023. Euromonitor International put out a great piece in February, highlighted by the chart below.

Inflation and interest rates

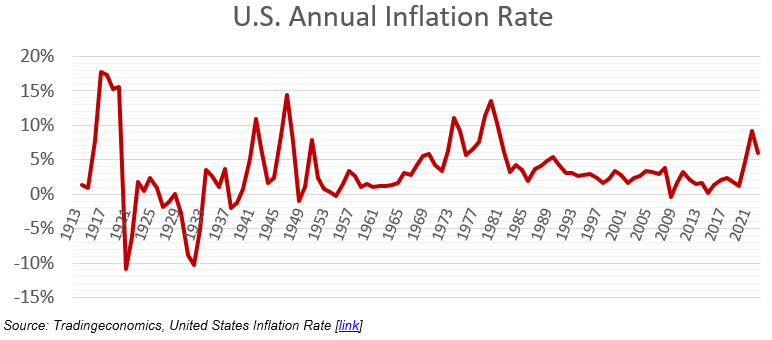

Inflation has been a significant concern for investors over the past year, with the U.S. experiencing its peak inflation rate of 9.1 percent in July 2022. However, we are pleased to report that inflation has decreased for eight consecutive months and, as of March 31, currently sits at six percent, which is still three times the Fed's current target of two percent. The U.S. federal funds rate has increased to five percent from its pandemic low of 0.25 percent. Despite economic data showing positive momentum, the Fed has indicated that there is always a possibility that further rate hikes may be necessary due to persistently high inflation levels. With U.S. Treasury yields exceeding five percent, many investors are flocking to these risk-free assets in search of safe returns while equity markets remain volatile.

While conservative investors can now achieve reasonable returns with high bond yields, there is a risk of potential troubles in the housing market as mortgages get renewed at higher rates, forcing some to sell and downsize. Going from nine percent to four percent inflation in the U.S. should be relatively easy. However, going from four to two percent would take longer due to stickier categories related to wage inflation moderating more slowly. Finally, experts expect U.S. inflation to hit three percent by the end of 2023.

In the U.K., inflation is higher now than last year, and the Bank of England (BoE) has lifted its interest rates to 4.25 percent and will likely have to continue this pace until inflation moderates substantially. Eurozone headline inflation fell from 8.5 percent in February to 6.9 percent in March, the most significant deceleration on record. The decline was driven mainly by a drop in energy prices relative to March of last year, when prices surged, following Russia's invasion of Ukraine. On the other hand, core CPI accelerated to an all-time high of 5.7 percent, potentially strengthening the case for further monetary policy tightening in the Euro area.

The global economy remains fragile as policymakers grapple with balancing economic growth and inflationary pressures. Central banks will continue to closely monitor economic data and adjust their policies accordingly, which could impact interest rates and inflation, going forward. Investors must stay informed and be prepared for potential changes in the financial landscape.

Banking crisis explained

In recent months, there has been growing concern over the stability of the banking sector, following the collapse of several major financial institutions. The root cause of the crisis is complex, involving various factors such as over-leveraged balance sheets, questionable lending practices, and weak regulatory oversight.

The crisis began with the sudden collapse of one of the largest banks in the country, which had been struggling with mounting losses on its mortgage portfolio. The bank's failure triggered panic among investors, causing a sharp drop in the stock market and a run on other financial institutions. To restore confidence, the government stepped in to bail out the failing banks and guarantee deposits held by savers. However, the government's intervention has only exacerbated the crisis, as investors have grown increasingly worried about the long-term sustainability of the banking system. Many are questioning the wisdom of propping up failing banks with taxpayer money, arguing that it sets a dangerous precedent and creates a moral hazard that encourages risky behaviour in the future.

What can be done to address the crisis? Some have called for a more aggressive approach to regulation, with tighter restrictions on lending practices and higher capital requirements for banks. Others argue that the government should focus on breaking up the largest banks, which they believe are too big to fail and pose a systemic economic risk. Still others argue that the crisis is a natural consequence of a flawed economic system that prioritizes short-term profits over long-term stability and that a fundamental overhaul of the financial system is needed.

In conclusion, the bank crisis is a complex and multifaceted problem requiring a comprehensive and sustained effort to address. It highlights the need for better regulation, transparency, and accountability in the financial sector. It also underscores the importance of a stable and resilient banking system for the health and well-being of the broader economy. As we move forward, we must remain vigilant in our efforts to ensure that the banking system is strong, secure, and able to meet the needs of the communities it serves.

What we’re watching

While the global economic recovery is expected to persist, there are still risks to be mindful of, such as a possible surge in inflation, a resurgence of Covid-19, and geopolitical tensions. The tightening of central bank policies worldwide has been successful for the most part, except in Europe, where higher fuel prices, a less favourable exchange rate, and less adaptable labour markets may prolong the period of high inflation.

- Conflicts in Ukraine and territorial flexing by China remain top geopolitical issues

- China to ease Covid policies and move toward reopening

- The focus of equity investing to shift from growth to value/profitability

- North American housing market to remain under heavy pressure

- Fixed-income investing is becoming more and more attractive with higher rates

Our latest news and videos

As we close out another quarter, we keep publishing short videos on our YouTube channel, covering all sorts of financial topics. Below are a few examples of recent videos we've done and a few of the articles Shiraz was featured in. Be sure to follow our channel, and if you have any specific topics you'd like us to cover in future videos, feel free to email Shiraz Ahmed at shiraz.ahmed@raymondjames.ca.

- How to “Spring Clean” Your Finances [view]

- CBC Interview | Federal Budget Overview [view]

- Current Bank Crisis Explained [view]

- My Top 5 Tax Tips [view]

Information in this article is from sources believed to be reliable; however, we cannot represent that it is accurate or complete, and it should not be considered personal taxation advice. We are not tax advisors, and we recommend clients seek independent advice from a professional advisor on tax-related matters. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Shiraz Ahmed, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor's circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member Canadian Investor Protection Fund. Raymond James (USA) Ltd. (RJLU) advisors may only conduct business with residents of the states and/or jurisdictions for which they are properly registered. Therefore, a response to a request for information may be delayed. Please note that not all of the investments and services mentioned are available in every state. Investors outside of the United States are subject to securities and tax regulations within their applicable jurisdictions that are not addressed on this site. Contact your local Raymond James office for information and availability. This website may provide links to other Internet sites for the convenience of users. RJLU is not responsible for the availability or content of these external sites, nor does RJLU endorse, warrant, or guarantee the products, services, or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy that RJLU adheres to. Investing in foreign securities involves risks, such as currency fluctuation, political risk, economic changes, and market risks. Raymond James (USA) Ltd., member FINRA/SIPC. This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy which Raymond James Ltd adheres to.