Commentary by Grant Laschowski and Shiraz Ahmed

In this issue:

- Global equities, fixed income and interest rates, and commodities

- Economic productivity concerns in Canada

- Canadian federal budget

- Economic calendar

- Educational resources

Welcome to the latest edition of our Investor Newsletter, where we provide you with insightful updates and analysis on the ever-evolving financial landscape. The past quarter witnessed a series of significant events that have shaped market dynamics and investor sentiment.

Global equities, fixed income and interest rates, and commodities

Global equities

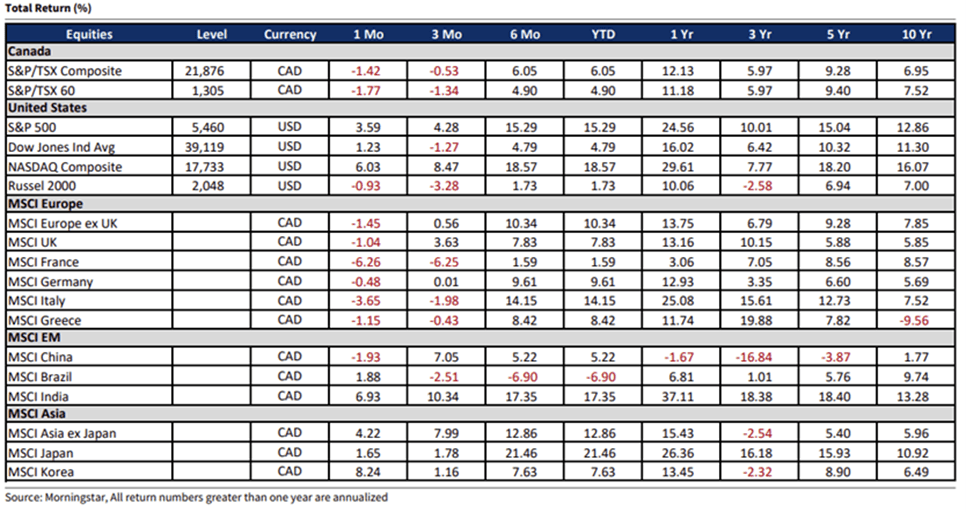

The second quarter of 2024 presented a mixed bag for North American markets. The Canadian stock market faced headwinds, underperforming compared to its southern neighbour. The S&P/TSX Composite Index saw a slight decline (-0.53%), primarily driven by rising unemployment and a slowdown in national production output.

In contrast, the U.S. markets exhibited resilience and growth, with the S&P 500 and NASDAQ posting gains of +4.28% and +8.47%, respectively. The U.S. economy's robustness, underpinned by strong consumer spending and technological advancements, contributed significantly to these gains.

European markets showcased a bifurcated performance, reflecting regional economic disparities. France, Italy, and Greece experienced declines due to political instability and economic restructuring challenges. Conversely, the U.K. and Germany reported gains, buoyed by strong industrial output and consumer confidence.

In Asia, markets generally performed well, led by China and India, whose economies are recovering strongly post-pandemic. Japan also showed positive signs, with its stock market benefiting from a weaker yen and increased export activity.

As illustrated in the chart above, the consumer staples sector in Canada demonstrated impressive performance during the initial phases of past interest rate cuts. This sector, comprising essential goods like food and household products, tends to be resilient during economic cycles. The ongoing demand for these essentials, even in times of economic uncertainty, has bolstered the sector. Companies in this space have also benefited from easing monetary policies, which have made borrowing cheaper and boosted consumer spending. This sector tends to have the highest average total return during the first six months after an initial rate cut.

The information technology sector has historically performed well, as most companies in this sector are focused on expansion, and lower interests tend to benefit growth stocks. Lower rates mean future cash flows are more valuable in present terms. As confidence in economic recovery increases, enthusiasm for investing in technological innovation, like the current excitement around AI, also grows. However, the sustainability of this enthusiasm hinges on the practical and meaningful applications of AI. Artificial intelligence (AI) continues to be a transformative force across various industries. The ongoing integration of AI technologies is reshaping business operations, enhancing productivity, and driving innovation. In the financial sector, AI is being used to improve decision-making, risk management, and customer service. The meaningful application of AI can significantly influence market dynamics, offering new opportunities for growth and efficiency.

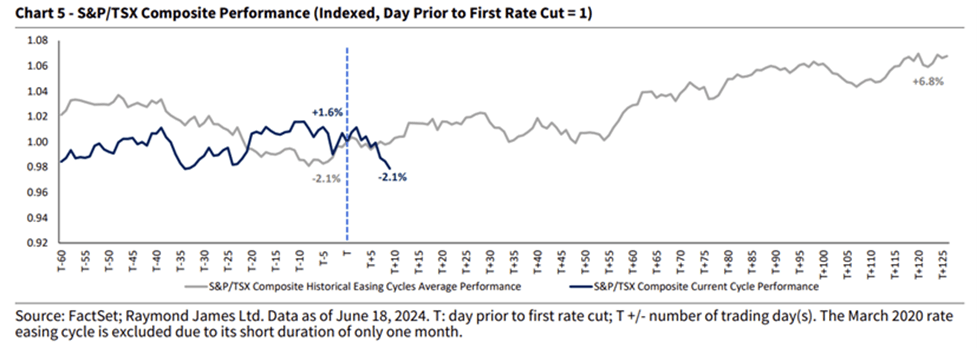

In the above chart, we analyzed the average daily return of the S&P/TSX Composite Index from three months before to six months after the first rate cut, comparing past rate easing cycles with the current one starting June 5th. Both the historical average and current cycle are indexed, with the day before the first rate cut marked as "T" and set to one.

Historically, pessimism about the economy and BoC rate decisions result in a ~2% decrease in returns three months before the first rate cut. Optimism rises post-cut, leading to a ~6% increase in returns in the following six months. For the current cycle, anticipated summer rate cuts were likely priced in early, and a gold price surge, given the S&P/TSX Composite’s 7% exposure to precious metals, boosted performance pre-cut.

In the first 10 trading days after this initial rate cut, we're seeing some index weakness, with ongoing concerns about future economic conditions and potential further rate cuts. Despite expected volatility, if a soft landing occurs and inflation nears the 2% target, the S&P/TSX Composite could finish 2024 with a high single-digit total return.

Fixed income and interest rates

Fixed income investments continue to be a cornerstone for risk-averse investors, offering stable returns in a volatile market environment. With one-year yields exceeding 5%, fixed income securities provide an attractive option for those seeking predictable income streams. The current interest rate environment, characterized by higher yields, has made these investments even more appealing.

In a significant policy shift, the Bank of Canada (BoC) recently lowered its policy interest rate for the first time in over four years. This move is part of a broader strategy to stimulate economic growth amid global uncertainties. The BoC anticipates further rate cuts, potentially up to three more this year, with projections indicating the policy rate could drop to 3.00% by mid-2025. These adjustments reflect a less restrictive monetary stance aimed at boosting economic activity and supporting employment.

Commodities

Assuming no unexpected disruptions to global supply, the energy markets appear balanced between current production levels and global demand. This stability is likely to keep oil prices within a narrow range through most of the third quarter.

Recent central bank rate cuts and expectations of further easing by the Federal Reserve have pushed gold prices higher. After some consolidation over the summer, gold may continue to rise amid easier global monetary policies. The anticipation of Fed easing should slow the appreciation of the U.S. dollar against other major currencies. However, the relative strength of the U.S. economy and significant interest rate differentials in the bond markets will likely prevent a sharp decline from current levels.

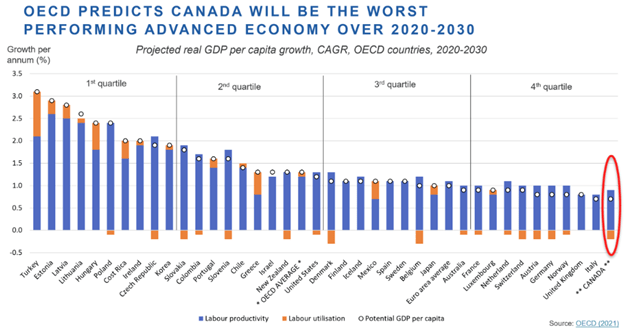

Economic Productivity Concerns in Canada

Canada's economic productivity, which measures the rate at which the output of goods and services are produced per unit of input (for example, labour, capital, and raw materials), remains a critical area of concern. While Canada ranks among the top countries to live in, its productivity doesn’t even hit the top 10 compared to other countries in the Organization for Economic Co-operation and Development (OECD). Ranking 18th among OECD countries in terms of GDP per hour worked, Canada lags behind many of its peers. This lower productivity impacts national competitiveness and living standards. Several factors contribute to this issue, including a higher proportion of small businesses, which often lack the resources for significant investment in productivity-enhancing technologies and training. Addressing these challenges will require concerted efforts from both the private sector and government to foster innovation and improve workforce skills.

Canadian Federal Budget

The 2024 Federal Budget has introduced several pivotal changes aimed at stimulating the economy and supporting Canadians. Key highlights include:

- Home Buyers’ Plan: The withdrawal limit has been increased from $35,000 to $60,000 for first-time homebuyers, providing greater flexibility and support in entering the housing market.

- Capital Gains Inclusion Rate: The rate has been increased from 50% to 67% for corporations and trusts. For individuals, the increase applies to capital gains exceeding $250,000, effective June 25, 2024.

- This change has garnered all the media attention, but in reality, it only affects 0.1% of the population.

- Think people with vacation properties that have been in the family for generations. Also affects corporations.

- Lifetime Capital Gains Exemption: This exemption has been raised by 25% to $1.25 million for dispositions occurring after June 25, 2024, offering substantial tax relief for investors.

- Canadian Entrepreneurs’ Incentive: A new initiative introduces a reduced tax rate on capital gains for qualifying business sales, encouraging entrepreneurial activity and investment.

- Education Savings: Automatic enrolment for the Canada Learning Bond has been established, with extended eligibility allowing for retroactive benefits claims up to age 30. This change aims to increase participation in education savings programs and support long-term educational planning.

For an in-depth analysis, watch Fidelity's Federal Budget Recap.

Economic calendar

Here is a list of some of the major economic data that is scheduled to be released during the third quarter of 2024.

- Interest Rate Decisions

- Canada: July 24 and September 4

- U.S.: July 31 and September 18

- European Union: July 18 and September 12

- Inflation Data Release

- Canada: July 16, August 20 and September 17

- U.S.: July 11, August 14 and September 11

- European Union: July 17, August 20 and September 18

- GDP Announcements

- Canada: July 31, August 30 and September 27

- U.S.: July 25, August 29 and September 26

- European Union: August 13 and September 6

Educational resources

As we close out another quarter, we also keep publishing short videos on our YouTube channel, covering all sorts of financial topics. Be sure to follow our channel, and if you have any specific topics you'd like us to cover in future videos, feel free to email Shiraz Ahmed at shiraz.ahmed@raymondjames.ca. Below are a few examples of some recent videos we've done and a few of the articles Shiraz was featured in.

- Luxury Bags Worth Investing in 2024 [click to view]

- BNN Interview [click to view]

- Canada's New Capital Gains Tax Update in 2024 [click to view]

Information in this article is from sources believed to be reliable; however, we cannot represent that it is accurate or complete, and it should not be considered personal taxation advice. We are not tax advisors, and we recommend that clients seek independent advice from a professional advisor on tax-related matters. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Shiraz Ahmed, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor's circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member Canadian Investor Protection Fund. Raymond James (USA) Ltd. (RJLU) advisors may only conduct business with residents of the states and/or jurisdictions for which they are properly registered. Therefore, a response to a request for information may be delayed. Please note that not all of the investments and services mentioned are available in every state. Investors outside of the United States are subject to securities and tax regulations within their applicable jurisdictions that are not addressed on this site. Contact your local Raymond James office for information and availability. This website may provide links to other Internet sites for the convenience of users. RJLU is not responsible for the availability or content of these external sites, nor does RJLU endorse, warrant, or guarantee the products, services, or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy that RJLU adheres to. Investing in foreign securities involves risks, such as currency fluctuation, political risk, economic changes, and market risks. Raymond James (USA) Ltd., member FINRA/SIPC. This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy which Raymond James Ltd adheres to.