2022 Q4 Investor Update Letter

In this issue:

- Global markets

- Inflation and interest rates

- The “R-word”

- What we’re watching in 2023

- Our latest news and videos

As the new year begins, we at Sartorial Wealth take this time to reflect on the past year and remember the importance of family, health, and wealth.

As a team, we enjoyed some well-deserved time off. Shiraz, the Founder of the practice, enjoyed his first family vacation since before COVID, in the Dominican Republic. Sarah, our Branch Administrator, enjoyed a low-key holiday season at home in Toronto with her loved ones. Justin, our Financial Planner, enjoyed some sun in Hawaii and time at home in Vancouver. Grant, our Associate Portfolio Manager, enjoyed the holidays at home in Toronto with family and friends.

These moments serve as a reminder of what truly matters in life and remind us to appreciate the little things. Despite the challenges faced in 2022, such as high gasoline and food prices, the joy of family and loved ones can make it all worth it.

We wish you all a safe and enjoyable holiday and new year, and we look forward to working with you in the coming year. Check out a few pics of the team over the holidays!

Global markets

For the better part of the last two decades, we have lived in a world governed by low borrowing costs (i.e., interest rates), blooming asset prices (i.e., real estate and stocks), strong government support, accommodative policies, and very strong investor sentiment. Unfortunately, we believe this is changing and quickly.

Consumer and business sentiment is extremely important for investors to know and follow as they can provide insights into the overall health of the economy. High levels of consumer and business confidence often indicate a strong economy and can lead to increased spending and investment, which can drive economic growth and lead to favorable conditions for businesses. On the other hand, low levels of consumer and business confidence can indicate a weaker economy and may lead to decreased spending and investment, which can negatively impact businesses. As a result, investors may want to keep an eye on consumer and business confidence levels as they can be important indicators of economic conditions and potentially impact the performance of their investments.

The United States Michigan Consumer Sentiment measures how consumers view prospects for their financial situation and the economy over both the near and long term. Since 1950, its measure has dipped below a reading of 60 only five times: 1975, 1980, 2008, 2012, and most recently, in 2022. Currently, at 59.1, it remains near its lowest level ever, a strong sign that individuals are not optimistic in the short term.

On the business side, the United States ISM Purchasing Managers Index (PMI) is based on data compiled from purchasing and supply executives nationwide. Survey responses reflect the change, if any, in the current month compared to the previous month. For each of the indicators measured, the report shows the percentage reporting each response, the net difference between the number of responses in the positive economic direction, the negative economic direction, and the diffusion index. A PMI reading above 50 percent indicates that the manufacturing economy is generally expanding while below 50 percent indicates it is generally declining. Currently, the index is sitting at 49 and has remained under 50 for the past three months.

Equities

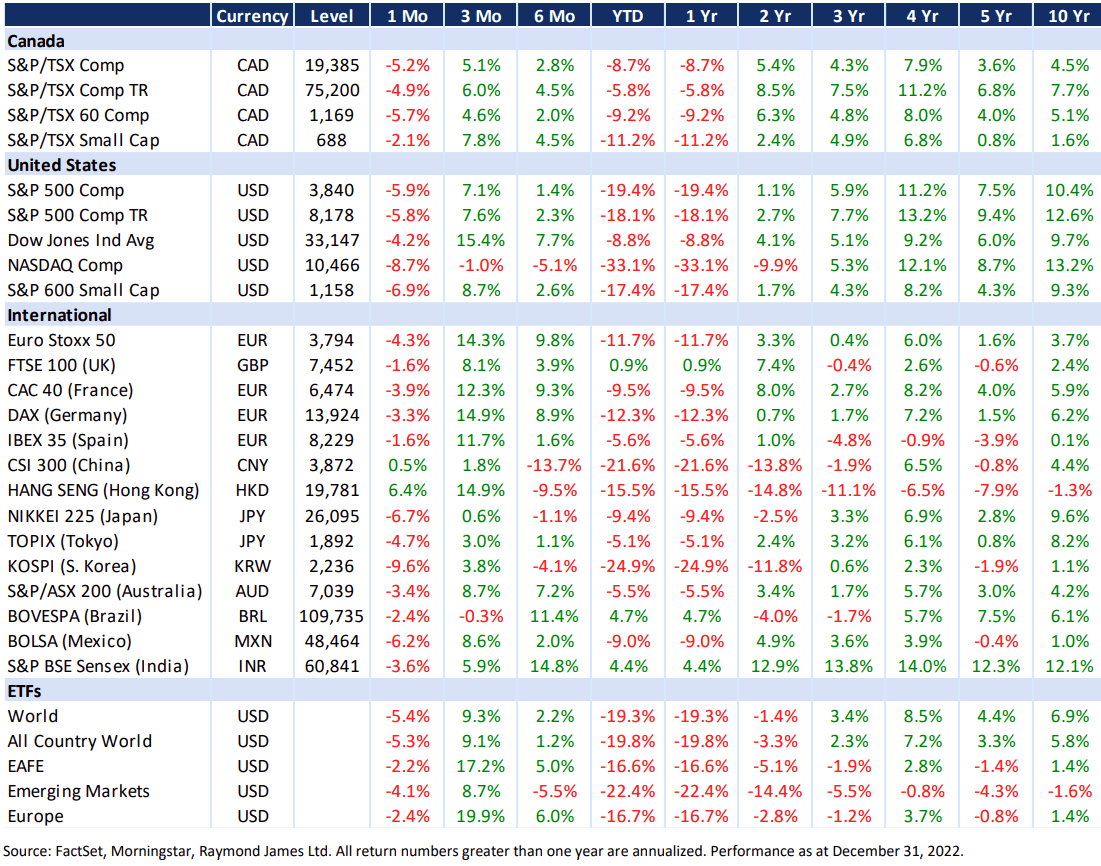

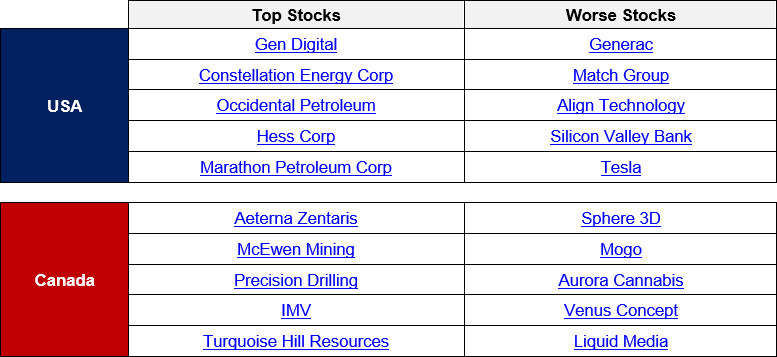

Several factors contributed to the market downturn in December. Some of these factors include economic uncertainty, trade tensions, and rising interest rates. Additionally, there were concerns about slowing global growth and the potential for a recession. All of these factors combined to create a negative market sentiment, which ultimately led to the market decline in December. That said, the fourth quarter of 2022 provided some much-needed market relief, as every index (except for Brazil) experienced positive returns.

The S&P 500 experienced its third worst year in the last 49 years; only in 2002 and 2008 did the index experience larger declines. The NASDAQ (-33.1 percent), KOSPI (-24.9 percent), and CSI 300 (-21.6 percent) indexes fared the worst, while the BOVESPA (+4.7 percent), S&P BSE Sensex (+4.4 percent), and FTSE 100 (+0.9 percent) were the only markets with positive returns in 2022.

Sources: S&P 500 Component Year-to-date Returns [link], Best Canada Stocks [link]

From a company performance perspective, we’ve highlighted above the best and worst Canadian and American listed stocks of 2022. Most of the top-performing stocks in both countries could be found in the energy sector, which finished 2022 up +24.4 percent in Canada and +59 percent in the U.S. The two worst sectors included information technology and real estate.

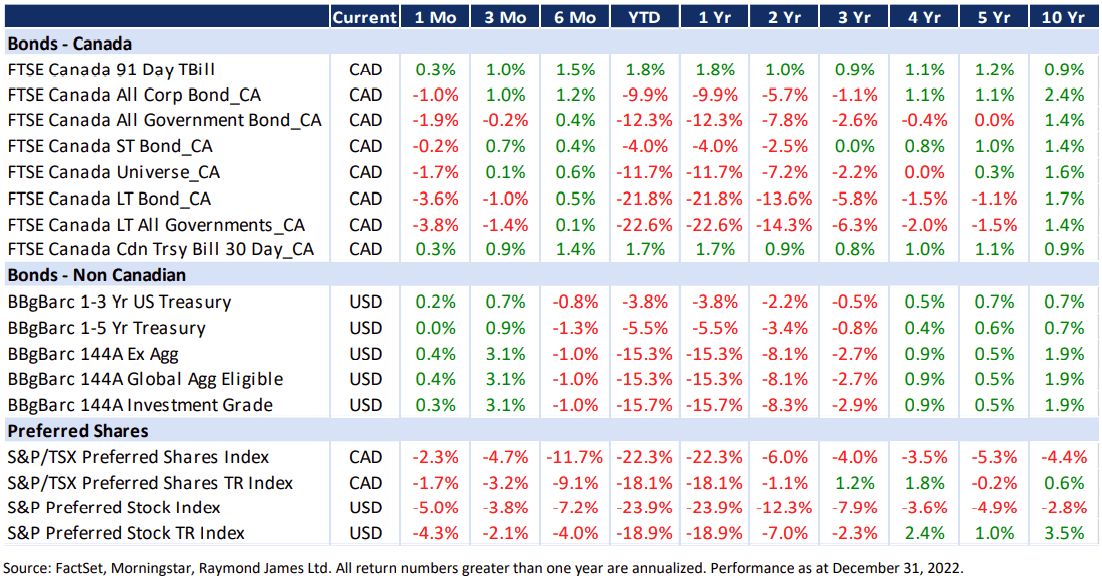

Fixed Income

For retirees and others living on a fixed income, last year was extremely challenging. Nearly every fixed-income index we follow posted negative returns in 2022. While a slight pullback in yields led to a broad-based recovery in the fourth quarter, last year proved to be one of the most difficult years on record for fixed income investors. There are a few factors that may have contributed to such a challenging year. One of the major factors was the large rate increases made by the central banks around the world. When rates are rising, it can lead to declines in the price of existing fixed-income investments, as those investments may become less attractive relative to newer investments that offer higher yields. In addition, there may have been other macroeconomic or market factors that affected the performance of fixed-income investments, such as changes in inflation expectations or shifts in investor sentiment. It's important to keep in mind that the performance of any particular investment can be affected by a wide range of factors and that past performance is not necessarily indicative of future results.

As mentioned in our Q3 Investor Update Letter, with rates on the move, conservative investors should now be strongly be looking at interest-bearing investments - in Canada, these are GICs and HISAs, and in the U.S., they are CDs, MMs, and Treasuries.

Until rates stabilize or decline (we are not expecting the latter anytime soon), we anticipate continued volatility and struggles for fixed-income investors.

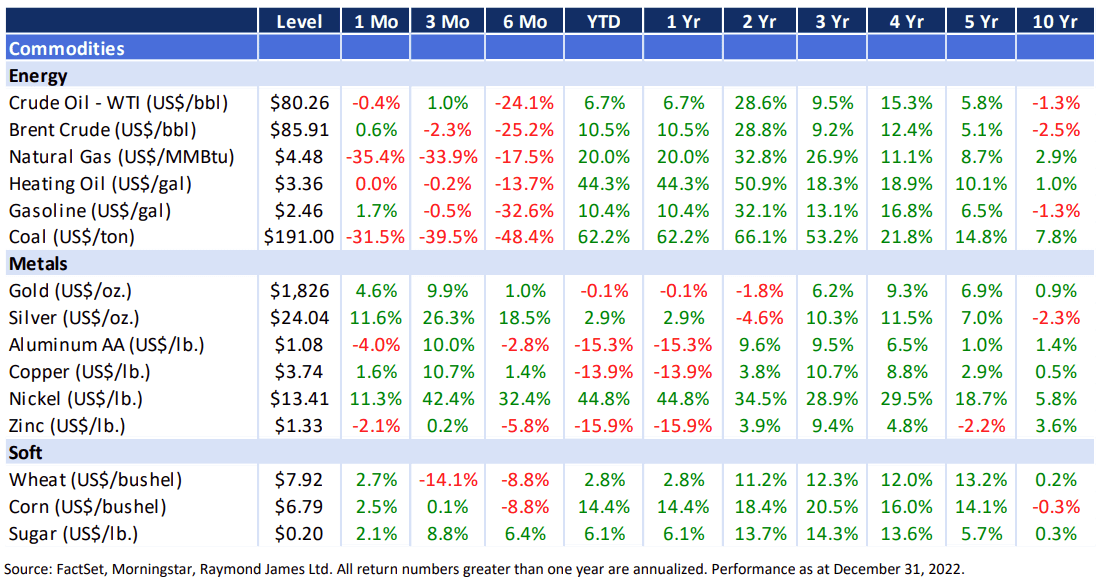

Commodities

Commodities were one of the few bright spots in 2022. Across the board, apart from a few metals (gold, aluminum, copper, and zinc), every commodity we follow posted positive returns last year. Coal, nickel, and heating oil all rallied hard, and each finished the year up over 40 percent.

Commodities such as oil, gold, and agricultural products can rise in price during times of inflation for a few different reasons. One reason is that during periods of high inflation, the purchasing power of money decreases, which means that people have to spend more money to buy the same goods and services. This can lead to an increase in the prices of goods, including commodities. Commodities are tangible assets that have intrinsic value and tend to maintain their value over time, while the value of paper money can be eroded by inflation. Additionally, in times of high inflation, governments may decide to increase interest rates, causing the currency to strengthen against other currencies. But as most commodities are traded in U.S. dollars, a stronger dollar can make these commodities more expensive for other countries that hold other currencies, in turn leading to higher prices. Finally, in some cases, supply and demand can also play a role in the rising prices of commodities during inflation. For example, if there is high demand for a commodity like oil but limited supply due to factors like geopolitical instability or natural disasters, this can lead to a rise in the price of oil.

As the conflict between Russia and Ukraine persists, and inflation remains high, commodities will likely continue to perform well in 2023.

Inflation and interest rates

Through conversations with clients, friends, and family, it has become quite evident that the understanding of inflation, interest rates, and their relationship with each other needs to be unpacked a bit.

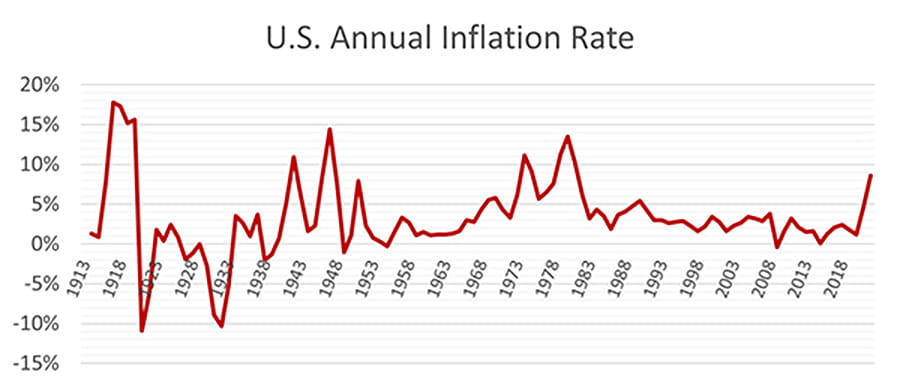

Let’s start by understanding what inflation is, how it’s measured, and why it matters.

Inflation is an increase in the general price level of goods and services in an economy over a specific period of time.

Take a moment to think about the cost of some common items like food, rent, furniture, clothing, gasoline, personal care, and education. Now, pretend all these costs were placed into a “basket” together. If the price of this basket increases, that is said to be inflationary and when it decreases, deflationary. So, when you hear in the news that annual inflation is six percent, what that means is that the price of this combined basket has increased by that amount compared to what it cost last year.

As with most things in life, a little bit of something is a good thing. In a healthy economy, wages, home prices, etc. all need to increase in value over the long run. In fact, in the U.S., they target an inflation rate of two percent.

Throughout 2020 and 2021, most of us spent time in and out of lockdowns as COVID worked its way through the world. To prevent a 1930s-like Great Depression, governments around the world slammed interest rates to near zero percent and embarked on a money-printing exercise like no other. This led to the fastest decline and subsequent recovery in the history of financial markets. With nowhere to spend all this free money, individual saving rates in the U.S. hit an all-time high of nearly 35 percent of disposable income. Over time, as the world slowly began to reopen, individuals began to spend, making up for all those lost vacations, date nights, home renovations, and family outings. With the global supply of these goods and services still restrained, there became fewer things to buy with all our savings. Simple supply and demand knowledge will tell us that when there is less supply and more demand, prices go up. That is what is happening now.

Source: Tradingeconomics, United States Inflation Rate [link]

So, how can inflation be controlled then?

The short answer is… interest rates.

Enter Jerome Powell, Chair of the Federal Reserve, who is tasked in the U.S. with controlling interest rates. When inflation or the cost of that basket of goods and services starts to increase too much, which it did in 2022, Mr. Powell walks over to his interest rate lever and starts pulling down. Why would increasing rates from 0.25 percent in January to over four percent 12 months later help control inflation? Imagine you’re looking to do a home renovation, buy a nice fancy car, or perhaps, own a business and want to expand. You’ll likely borrow some money to finance these activities. Now, ask yourself, would you rather borrow money at one percent or six percent? Higher rates are less attractive and if raised high enough, actually deter us from borrowing (i.e., thus spending) at all. Now, back to the supply/demand example. With higher rates, demand decreases and thus leads to lower prices. This is exactly what Mr. Powell is trying to achieve. The global focus is typically on what the U.S. Federal Reserve does. However, the same thing is happening within most central banks worldwide, including the Bank of Canada.

If the government didn’t print so much money over the last few years, in an effort to help us all maintain our standard of living, we wouldn’t be going through the present situation. The alternative, of not helping us at all during the pandemic, could have led to a much worse outcome. See: The Great Depression of 1929-1939.

One positive of higher interest rates comes in the form of higher yields for fixed-income investors. One year ago, five-year GICs in Canada yielded only 2.15 percent. Today, that same GIC yields nearly five percent - a roughly 130 percent increase in less than 12 months. For the first time, our careers, GICs, and HISAs are all topic in client review meetings. Whether investors are looking to build up their cash war chest or grow their rainy-day funds, cash options are more attractive now than at any other point in the last decade.

The R-word

As children, we were taught not to curse. Now, as adults and advisors, it has seemed to change to the R-word, recession.

We’ve come to understand, through business school and our professional working career, the definition of recession to be “a period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in two successive quarters.”

This occurred in the first two quarters of 2020 and again in 2022. During the 2020 recession, it was clear to everyone that we were in one. This year, it’s still up for debate. If the definition of a recession has played out this year, why are we still wondering if we are in a recession at all?

Well, in July, the White House published a piece querying the existing definition of a recession. Here is an excerpt from the article:

“What is a recession? While some maintain that two consecutive quarters of falling real GDP constitute a recession, that is neither the official definition nor the way economists evaluate the state of the business cycle. Instead, both official determinations of recessions and economists’ assessment of economic activity are based on a holistic look at the data—including the labor market, consumer and business spending, industrial production, and incomes. Based on these data, it is unlikely that the decline in GDP in the first quarter of this year—even if followed by another GDP decline in the second quarter—indicates a recession.”

So, while GDP declined in the U.S. during the first two quarters of 2022, several other indicators (i.e., real income, spending, industrial production) all point to a healthier economy than the news would lead us to believe. While determining if we are going into a recession, are in one already, or have come out of one is still up for debate, one thing is certain – the current economic landscape has severely dampened investor sentiment.

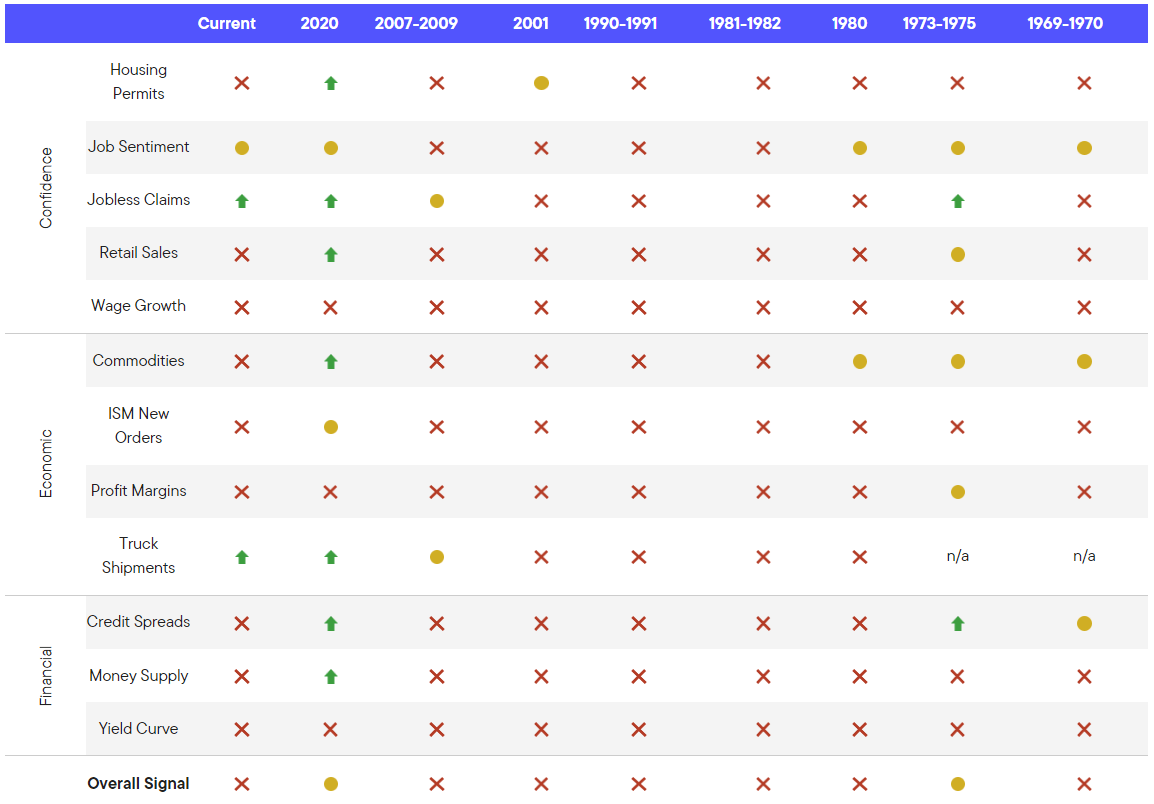

One way investors can keep up with recessionary developments is by looking at what’s known as recession risk indicators. The chart below, published by Franklin Templeton – a large multinational asset management firm – shows the breakdown of various consumer, business, and financial metrics in the U.S. during past recessions.

Comparing the current economic landscape with previous recessions, we attempt to answer this year’s million-dollar question, “Are we in a recession?” If I had to guess, I’d say we are, but how it all plays out is yet to be seen.

Source: Franklin Templeton, U.S. Economy: Anatomy of a Recession [link]

Now, before moving on, we’d like to leave you with a metaphor explaining recession:

A recession can be thought of as a marathon runner hitting a wall. Just as a runner may experience a sudden and unexpected loss of energy and stamina during a marathon, an economy can experience a sudden downturn after a period of growth. Both the runner and the economy may need time to rest and recover before they are able to pick up the pace again and continue on their journey. Just as a runner can take steps to prevent hitting the wall, such as pacing themselves and fueling up with the right nutrients, governments and central banks can implement policies to try to prevent or mitigate the effects of a recession on the economy.

What we’re watching in 2023

- Conflicts in Ukraine and territorial flexing by China remain top geopolitical issues

- China to ease COVID policies and move toward reopening

- Global economic growth to slow

- Inflation is likely to slowly cool, but remain elevated

- Interest rates to remain near current levels, no cuts expected in 2023

- The focus of equity investing to shift from growth to value/profitability

- North American housing market to remain under heavy pressure

- Fixed income investing becoming more and more attractive with higher rates

- USD to remain strong relative to other currencies

- The U.S. economy aims for a soft landing

Our latest news and videos

As we close out another quarter, we've got some exciting news to share. Shiraz was recently honoured with the 2022 Top Under 40 award from the Investment Industry Association of Canada. This award recognizes young professionals in the industry who have achieved great things and we're thrilled that Shiraz's hard work and dedication have been recognized in this way.

In other news, Shiraz has also been featured in multiple publications like The Globe and Mail, Investment Executive, Wealth Professional, and The Lawyer’s Daily, to name a few, over the past quarter. He was interviewed and quoted on various financial topics and strategies, sharing his expert cross border knowledge and insights.

We also keep publishing short videos on our YouTube channel, covering all sorts of financial topics. Be sure to follow our channel, and if you have any specific topics you'd like us to cover in future videos, feel free to email Shiraz Ahmed at shiraz.ahmed@raymondjames.ca. Below are a few examples of some recent videos we've done and a few of the articles Shiraz was featured in.

- The biggest scandal of our generation | FTX [view]

- Tech layoffs | Meta, Facebook, Twitter [view]

- The Silver Lining of High Inflation [view]

- Top under 40 Press Release [view]

- Globe and Mail Article [view]

- Investment Executive Article [view]

Information in this article is from sources believed to be reliable; however, we cannot represent that it is accurate or complete, and it should not be considered personal taxation advice. We are not tax advisors, and we recommend that clients seek independent advice from a professional advisor on tax-related matters. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Shiraz Ahmed, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor's circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member Canadian Investor Protection Fund. Raymond James (USA) Ltd. (RJLU) advisors may only conduct business with residents of the states and/or jurisdictions for which they are properly registered. Therefore, a response to a request for information may be delayed. Please note that not all of the investments and services mentioned are available in every state. Investors outside of the United States are subject to securities and tax regulations within their applicable jurisdictions that are not addressed on this site. Contact your local Raymond James office for information and availability. This website may provide links to other Internet sites for the convenience of users. RJLU is not responsible for the availability or content of these external sites, nor does RJLU endorse, warrant, or guarantee the products, services, or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy that RJLU adheres to. Investing in foreign securities involves risks, such as currency fluctuation, political risk, economic changes, and market risks. Raymond James (USA) Ltd., member FINRA/SIPC. This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy which Raymond James Ltd adheres to.